Vigilant Asset Location ETF Vigilant Asset Location ETF Vigilant Asset Location ETF

Offensive STRATEGY

Vigilant asset allocation G4

Distributing

Table of contents

1. Details

The Vigilant Asset Allocation – G4 strategy was developed by Wouter Keller and JW Keuning building upon their research paper titled “Breadth Momentum and Vigilant Asset Allocation (VAA).” This strategy employs a “breadth momentum” test to determine the allocation between risk and safe assets in the portfolio. On average, the strategy allocates 41% to equities, 36% to bonds, and 23% to cash. (Source : https://portfoliodb.co)

In the context of ETFs, distributing means the fund pays out income (e.g., dividends or interest) directly to investors at regular intervals. This provides a cash flow that can be used or reinvested elsewhere. In contrast, accumulating ETFs reinvest this income back into the fund, increasing its overall value and compounding growth. The choice between the two depends on whether an investor prioritizes income or capital growth.

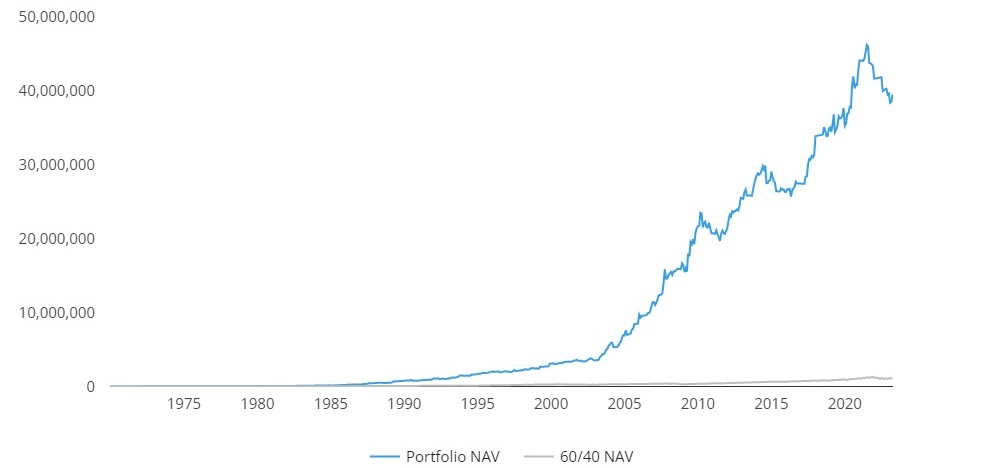

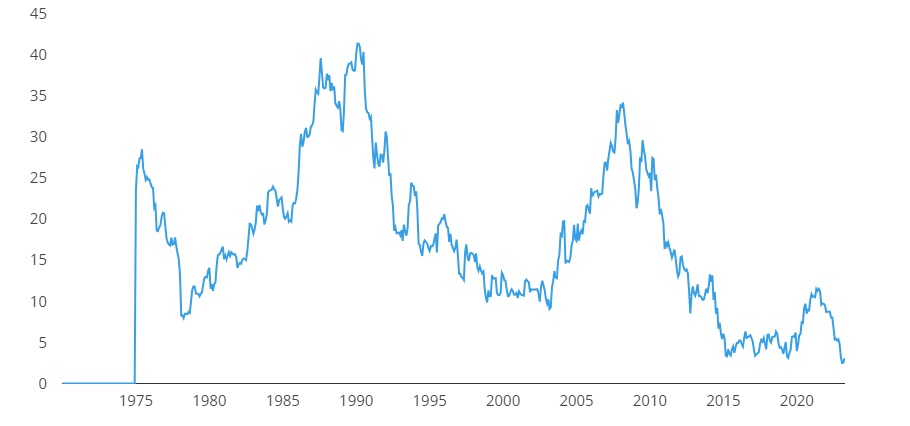

2. Performance

Source : https://portfoliodb.co

3. Instructions

Read

Read the result in 4. Strategy Results (by clicking here).

This is the ETF selected from a hand-picked list of ETFs (see the list by clicking here) using the mathematical formula and which would be the investment offering the best return today.

Invest

Invest 100% of your investment in the ETF indicated in 4. Strategy Results (click here) via a trading platform.

Maintain or Change

If you have already invested in this ETF the previous month and the ETF is still recommended, maintain your position.

If the ETF indicated in point 2 has changed, sell your position and reinvest the entire amount in the ETF indicated in point 2.

Restart

Each month, start again the process

4. Strategy Results

If the result is not displayed, please wait a few seconds or clear your browser’s cache.

If you don’t know how to clear your browser’s cache, click here.If you are on your smartphone, reload the page.

5. Recommended ETFs

The ETFs used in this strategy are made up of offensive and defensive ETFs composed of either stocks or bonds in several geographical zones around the world, in order to diversify your investment as much as possible and thus limit risk.

Offensive ETFs

SPDR S&P 500 ETF Trust – SPY

iShares MSCI EAFE ETF – EFA

iShares MSCI Emerging Markets ETF – EEM

iShares Core US Aggregate Bond ETF – AGG

Defensive ETFs

iShares iBoxx $ Inv Grade Corporate Bond ETF – LQD

iShares 7-10 Year Treasury Bond ETF – IEF

SPDR Bloomberg 1-3 Month T-Bill ETF – BIL

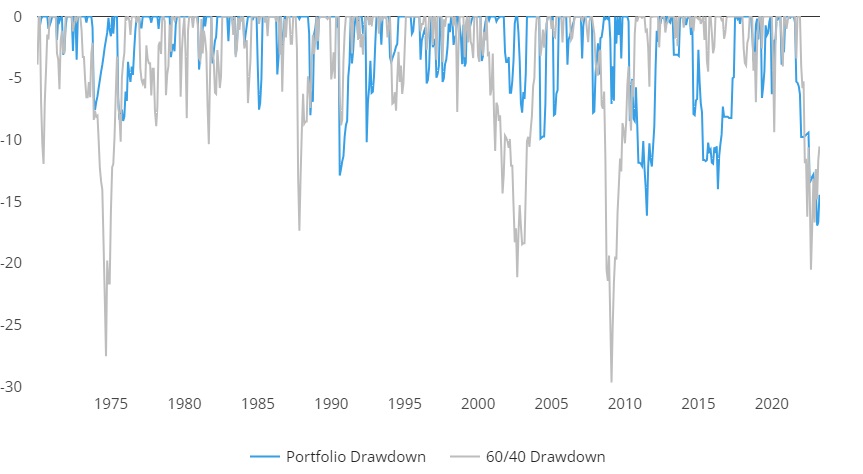

6. Returns & Drawdowns

6.1 Returns

Source : https://portfoliodb.co

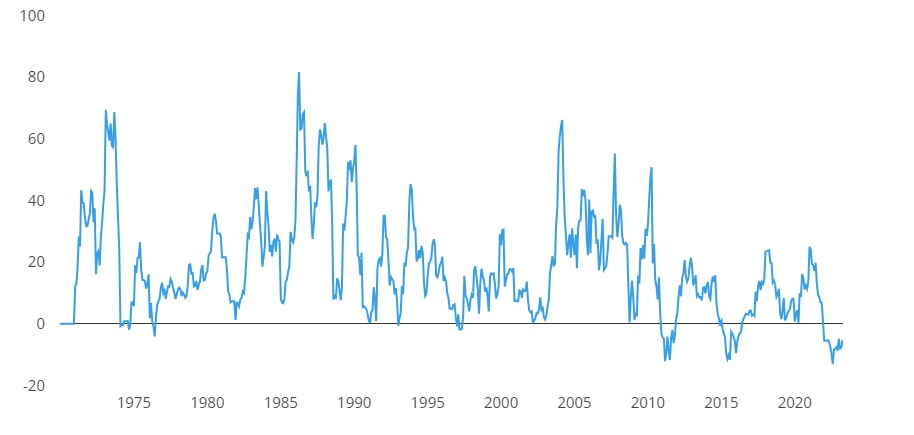

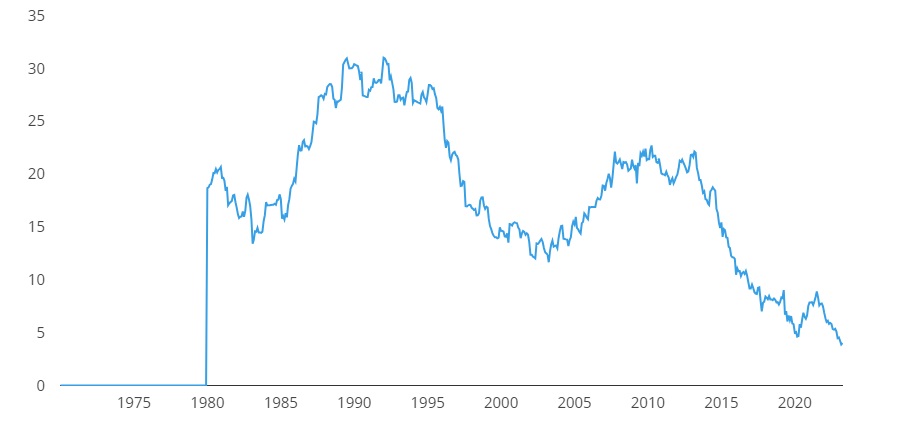

6.2 Rolling Returns

6.3 Drawdowns

6.4 1-Year Rolling Returns

Source : https://portfoliodb.co

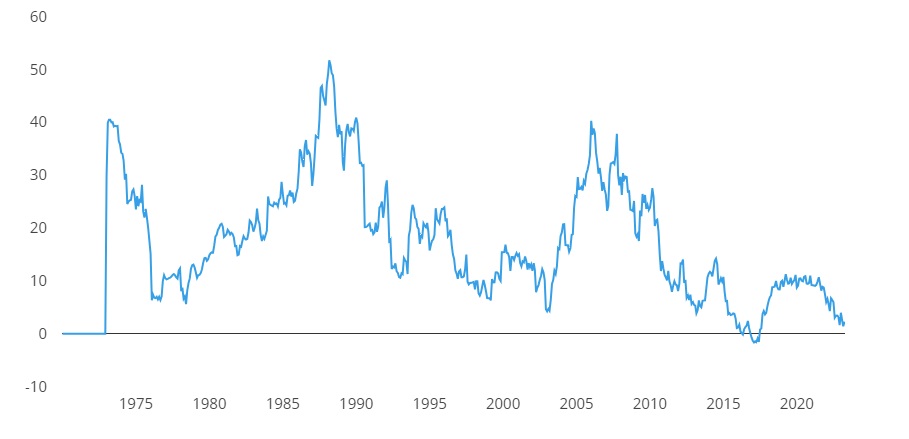

6.5 3-Year Rolling Returns

Source : https://portfoliodb.co

6.6 5-Year Rolling Returns

Source : https://portfoliodb.co

6.7 10-Year Rolling Returns

Source : https://portfoliodb.co

7. Risks

Investing Disclaimer

We want to remind you that all investments carry inherent risks, and it is important to make informed decisions. While we provide a range of investment strategies, we cannot guarantee any profits or take responsibility for potential losses incurred while using any of our strategies.

Financial markets are volatile and unpredictable, and past performance does not guarantee future results. Before making any investment decision, we encourage you to consult a financial advisor or perform thorough research to ensure the selected strategy aligns with your personal financial goals.

We strive to provide accurate and insightful information based on our expertise. However, please understand that investing inherently involves risks, including the possibility of losing part or all of your invested capital.

By using any of our strategies, you accept the associated risks and acknowledge that we are not liable for any losses you may incur.

Important Notes:

- Investors must be prepared to face potential losses when using these strategies.

- The content and resources provided on this Website are for informational purposes only and do not constitute financial, tax, legal, or accounting advice.

- We are not a law firm or a professional advisory service. For personalized guidance, please consult a qualified advisor who understands your specific situation.