defensive asset allocation Keller Keuning DAA ETF defensive asset allocation Keller Keuning DAA ETF

Defensive Strategy

Defensive Asset Allocation

ETF Strategy

Table of contents

1. Details

Investing with the Defensive Asset Allocation strategy, pioneered by Wouter Keller and JW Keuning, delivers a dynamic approach to market fluctuations.

Drawing from their groundbreaking paper, “Breadth Momentum and the Canary Universe: Defensive Asset Allocation (DAA),” this strategy leverages momentum, particularly focusing on recent market trends.

A unique feature is the incorporation of “breadth momentum,” a system that guides the allocation towards defensive assets. Typically, the strategy distributes investments with 43% in equities, 40% in bonds, and 17% in REITs, Gold, and Commodities.

With its strategic balance and adaptability to market shifts, this approach holds significant appeal for savvy investors seeking to optimize their portfolios.

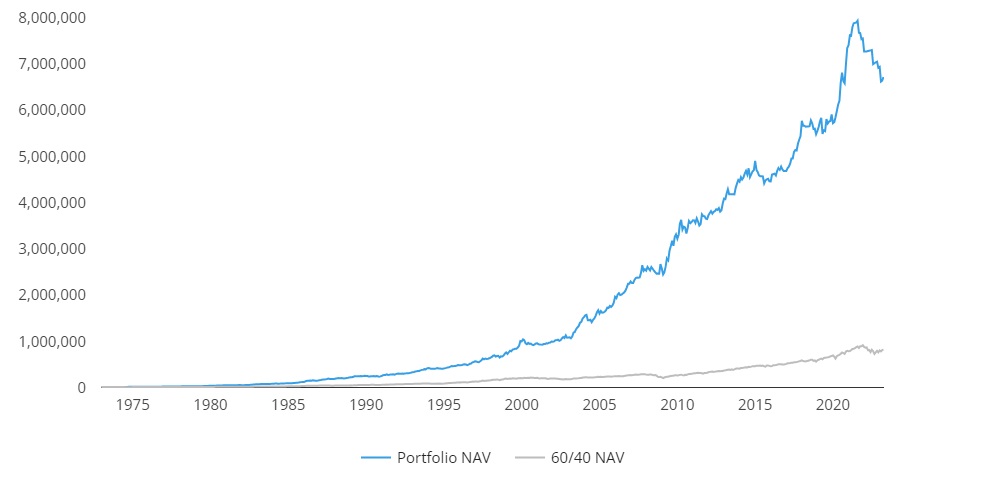

2. Performance

Source : https://portfoliodb.co

3. Instructions

Read

Read the result in 4. Strategy Results (by clicking here).

This is the ETF selected from a hand-picked list of ETFs (see the list by clicking here) using the mathematical formula and which would be the investment offering the best return today.

Invest

Invest 100% of your investment in the ETF indicated in 4. Strategy Results (click here) via a trading platform.

Maintain or Change

If you have already invested in this ETF the previous month and the ETF is still recommended, maintain your position.

If the ETF indicated in point 2 has changed, sell your position and reinvest the entire amount in the ETF indicated in point 2.

Restart

Each month, start again the process

4. Strategy Result

If the result is not displayed, please wait a few seconds or clear your browser’s cache.

If you don’t know how to clear your browser’s cache, click here.If you are on your smartphone, reload the page.

5. Recommended ETFs

Source : https://portfoliodb.co

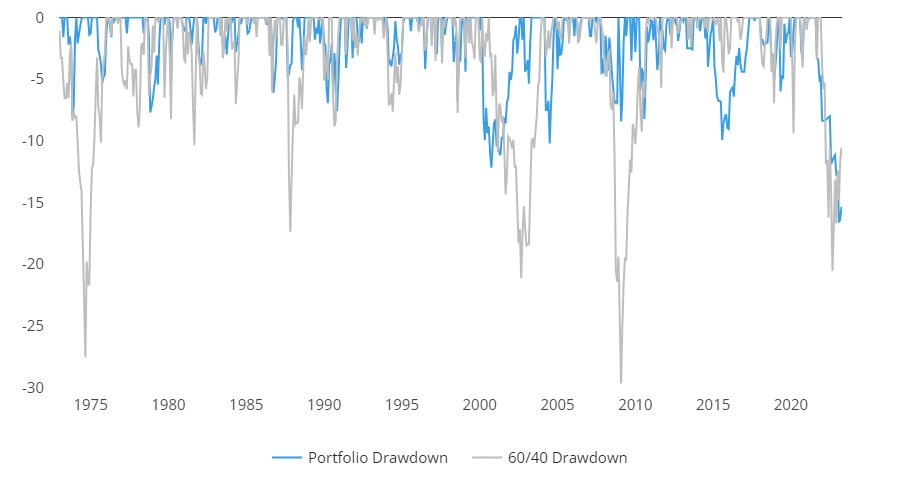

6. Returns & Drawdowns

6.1 Returns

Source : https://portfoliodb.co

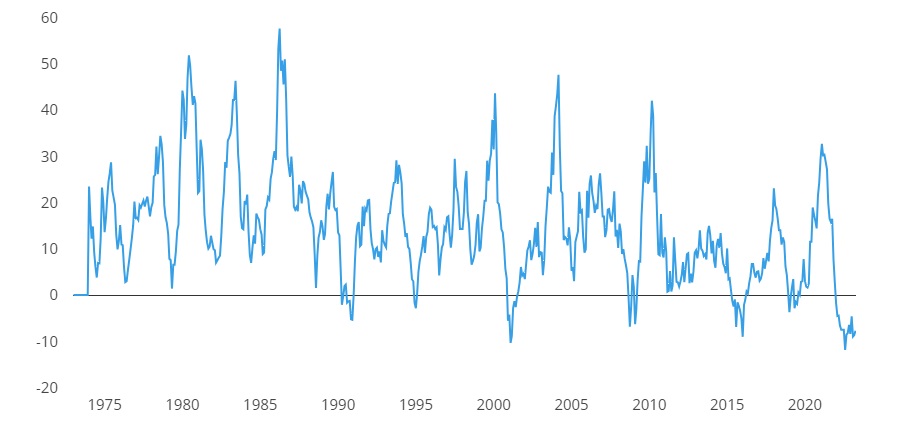

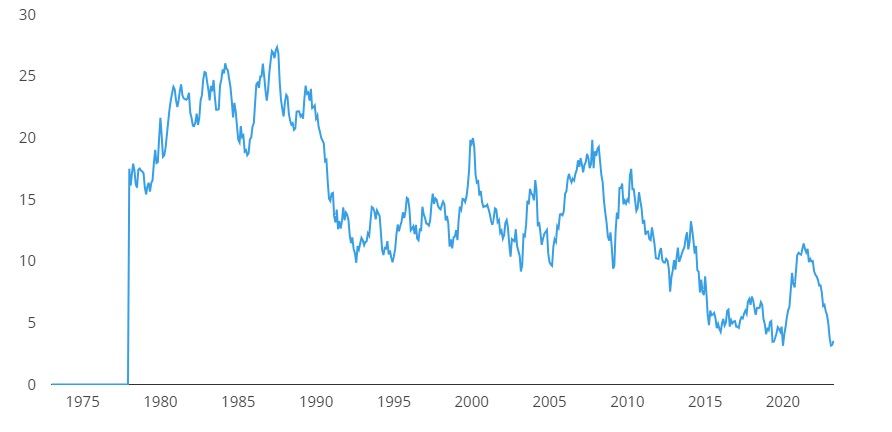

6.2 Rolling Returns

6.3 Drawdown

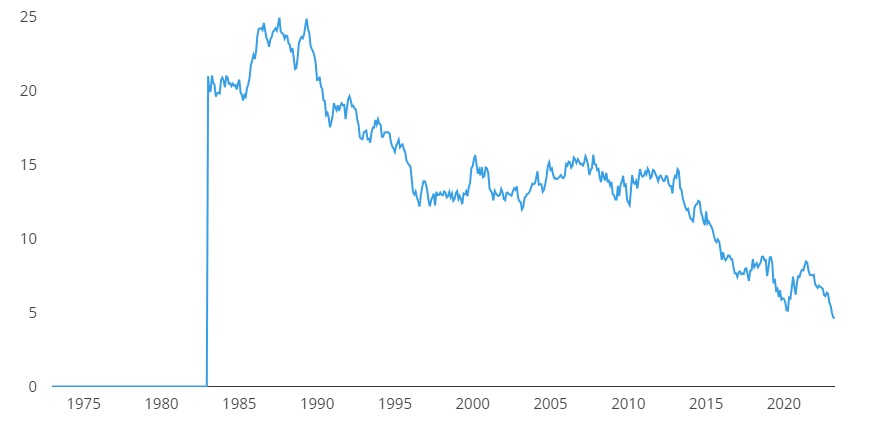

6.4 1-Year Rolling Returns

6.5 3-Year Rolling Returns

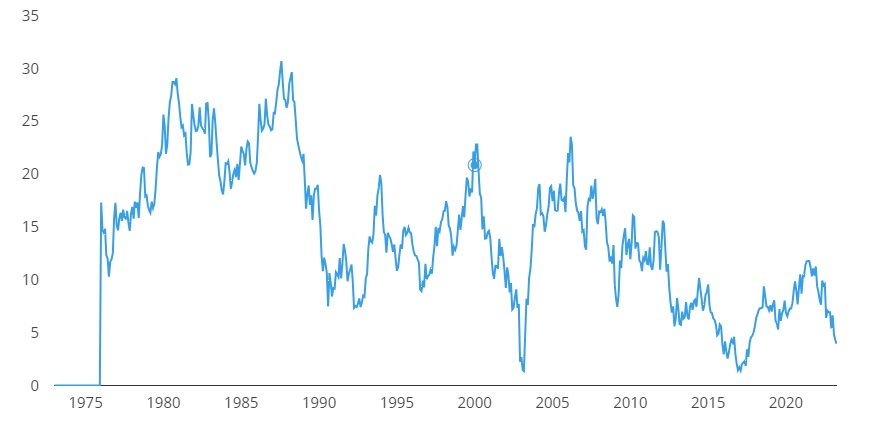

6.6 5-Year Rolling Returns

6.7 10-Year Rolling Returns

7. Risks

Investing Disclaimer

We want to remind you that all investments carry inherent risks, and it is important to make informed decisions. While we provide a range of investment strategies, we cannot guarantee any profits or take responsibility for potential losses incurred while using any of our strategies.

Financial markets are volatile and unpredictable, and past performance does not guarantee future results. Before making any investment decision, we encourage you to consult a financial advisor or perform thorough research to ensure the selected strategy aligns with your personal financial goals.

We strive to provide accurate and insightful information based on our expertise. However, please understand that investing inherently involves risks, including the possibility of losing part or all of your invested capital.

By using any of our strategies, you accept the associated risks and acknowledge that we are not liable for any losses you may incur.

Important Notes:

- Investors must be prepared to face potential losses when using these strategies.

- The content and resources provided on this Website are for informational purposes only and do not constitute financial, tax, legal, or accounting advice.

- We are not a law firm or a professional advisory service. For personalized guidance, please consult a qualified advisor who understands your specific situation.