Our Vision Our Vision Our Vision

Our Vision

What is our Vision?

Goals, Strategies, and Expected Performances

Our Goal

What is the aim of this website?

The purpose of this website is to provide access to a diverse range of investment strategies, many of which are available free of charge. Premium strategies are also offered at a competitive price, providing additional tools for investors seeking more advanced options.

The strategies available are particularly suitable for novice investors who wish to start investing in ETFs but need guidance on how to begin.

They are also designed for more experienced investors seeking strategies to invest in ETFs with a focus on balancing performance and risk management. Vigiplan Invest’s strategy offers a structured approach tailored to this category of investors.

The approach adopted follows a long-term investment strategy designed to optimise returns while managing risk, through a diversified asset allocation among carefully selected ETFs and REITs.

Daily calculations associated with those strategies provide recommendations on ETFs or REITs that align with current market conditions, offering insights into potential opportunities.

Additionally, we provide investors with up-to-date information on the financial markets, enabling informed investment decisions tailored to individual risk preferences. This feature is exclusively available in the premium version.

THE STRATEGIES

What is our approach?

Access

How can I access this information?

Advantages:

- Simplicity: The strategies are designed to be easy to understand and apply, making them accessible to a wide range of investors.

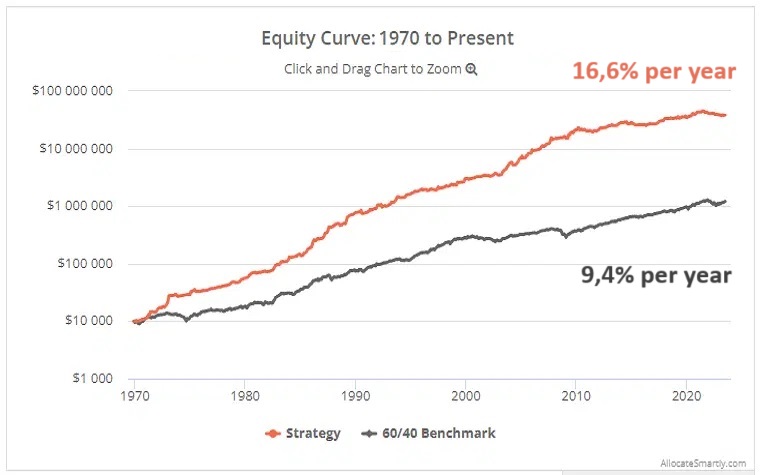

- Potential for higher returns: The ETF or REITs strategies aim to provide a potential yield that may exceed traditional approaches, such as the “60/40 strategy”.

- Adaptability to market conditions: The strategies seek to optimise returns while managing risk effectively.

- Risk diversification: By diversifying portfolios across a wide range of ETFs or REITs, the strategies aim to reduce overall investment risk.

Disadvantages:

- Limited flexibility: Investors may need to adhere to specific strategy parameters, which could limit their ability to make adjustments.

- Potential volatility: Some strategies may involve higher levels of risk and volatility depending on market conditions.

This investment strategy operates transparently:

- The VigiPlan Invest solution provides analysis and insights into the performance of a curated selection of ETFs.

- Investors can review and decide to invest in these ETFs independently and at their own pace.

It’s designed to be straightforward and user-friendly.

Overview

How does it work?

ETF

What is an ETF?

ETFs are investment funds that track the performance of a specific index – like the S&P 500, Nasdaq, Dow Jones, CAC40,… Just like stocks, you can trade ETFs on a stock exchange at any point during market hours. Whether you’re an individual looking to invest, or a seasoned financial professional, ETFs are an easy and powerful investment option to help meet your goals.

source : https://www.blackrock.com/sg/en/ishares/education/what-is-an-etf

THE STRATEGIES

What are the expected performances?

For example, the Vigilant Asset Location G4 strategy has already yielded an average return of 16.6% per year over the last 50 years

Experience

What will you experience?

Stock market data

Stock market data is retrieved daily for an accurate analysis.

Budgeting

Allocate a small portion of your money each month to diversify your investments and reduce risk.

Improved diversification

Invest in a selection of high-yield ETFs to diversify your portfolio while reducing risk.

Increased investor satisfaction

This strategy simplifies the investment choices, which can improve investor satisfaction

Better decision-making

Key Financial Market Evaluation Indicators are provided to help investors make informed decisions

Reactivity

The strategy employed is adaptive and can evolve in response to changing market conditions.

Get Started

ETF Free Strategies

ETF Premium Strategy

Strategies

Ivy Portfolio Strategy – Free

Annual Return: 13.1%

Balanced ETF allocation among stocks, bonds, commodities, and real estate to maximize returns while minimizing risks.

Defensive Asset Location – Free

Annual Return: 13.8%

Defensive ETF allocation favoring assets considered less volatile or more resilient to market fluctuations.

Risks

What are the risks?

Investing Disclaimer

We want to remind you that all investments carry inherent risks, and it is important to make informed decisions. While we provide a range of investment strategies, we cannot guarantee any profits or take responsibility for potential losses incurred while using any of our strategies.

Financial markets are volatile and unpredictable, and past performance does not guarantee future results. Before making any investment decision, we encourage you to consult a financial advisor or perform thorough research to ensure the selected strategy aligns with your personal financial goals.

We strive to provide accurate and insightful information based on our expertise. However, please understand that investing inherently involves risks, including the possibility of losing part or all of your invested capital.

By using any of our strategies, you accept the associated risks and acknowledge that we are not liable for any losses you may incur.

Important Notes:

- Investors must be prepared to face potential losses when using these strategies.

- The content and resources provided on this Website are for informational purposes only and do not constitute financial, tax, legal, or accounting advice.

- We are not a law firm or a professional advisory service. For personalized guidance, please consult a qualified advisor who understands your specific situation.

Overview

How to Invest?

Our Vision

Pricing

Strategies

Magnificent Seven Portfolio

Vigilant Asset Location G4

Ivy Portfolio

Defensive Asset Location